Are you thinking about boosting your income with an investment property? If you’re in a popular location, you could be on the right track when it comes to enhancing your financial portfolio. Rental properties can be extremely profitable, if you’re smart about buying, maintaining, and managing them. So if you’re interested in purchasing your first investment property, here are some steps to get your rental off to a stress-free start.

Determine a Prime Location

When it comes to rental profits, it’s all about location. Narrowing down your choice to specific neighborhoods can be tricky, but you can’t really go wrong with investment properties that are close to popular local attractions. The more conveniently located your property is to exciting attractions, relaxing areas, and top local restaurants that people want to visit, the more popular your rental will be.

Purchase a Desirable Property

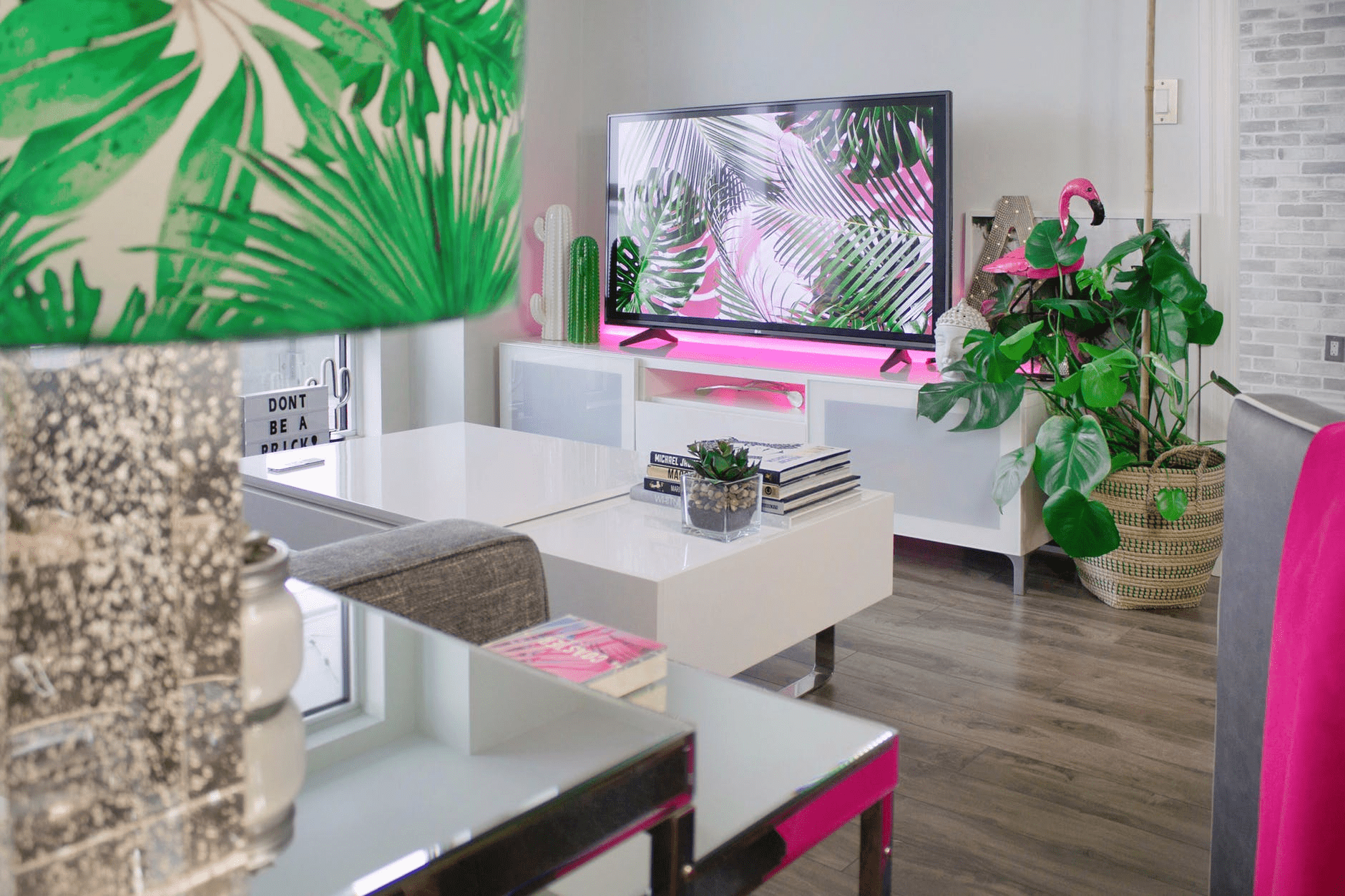

What your property looks like can count just as much as where it is located. So if you want to draw the most tenants, choose an investment property that will attract the most attention. Whether it’s a beach cottage, a downtown condominium or a spacious house, selecting a property type that suits the needs of your target rental audience can mean more profits in your wallet, plus choosing the right-size home can mean less maintenance costs for your budget.

Factor in Any Needed Home Improvements

As you search for desirable properties, you need to be careful of just looking at the sticker price on available homes (homes in Durham have a median listing price of $292,000). Because even though that price may be within your investment property budget, your new home may need a few upgrades to attract desirable tenants and reviews.

For instance, if you’re purchasing a vacation rental, some of the most popular rental amenities that vacationers look for in a listing include free parking, new appliances, and relaxing outdoor spaces, so you may need to allot some of your funding to buying appliances or revamping the driveways and patio areas. If you’re planning to rent to families, installing a home security system and generator in case of a power outage can make your property more attractive. Keep in mind that if you’re planning to install a generator, gasoline generators are usually the most cost-effective option (with installation typically ranging from $550 to $3,000).

Find a Lender with Low Investment Loan Rates

Investment property mortgages can be a little more complicated to secure than financing for traditional homes. If you are thinking about purchasing a rental property, however, you likely have the credit score and assets needed to qualify for a desirable loan to help secure your first investment property. Just be sure to research different lenders and compare loan rates, so that you can find the best deal and ensure the most profit returns on your real estate investment.

Look for Ways to Save on Upgrades & Maintenance

One of the trickiest parts of getting started with a rental property is finding enough funding to cover your initial home purchase and any necessary upgrades or regular maintenance costs. Average maintenance expenses for a rental property can be as low as $75 a month or higher than $350 a month, depending on the size, location, and features of that property. Of course, you can save on monthly costs by making budget-friendly changes both inside and outside the property. For example, creating water-efficient outdoor spaces can help keep monthly upkeep costs low.

Take Advantage of Investment Property Tax Deductions

As you prep your home for renters and manage your property in the coming years, keeping maintenance costs low will continue to be important. It’s also worth noting that you can use rental property tax breaks to help offset the costs of maintaining and managing your investment property. For instance, if you hire contractors to make qualifying repairs or upgrades to your rental property, you can deduct some of those costs from your tax bill. You can also take credits for other expenses related to managing your property, including utilities, fees, and travel costs.

Hire a Property Manager

Handling the ins and outs of renting out an investment property can be time-consuming and inconvenient if you don’t live in the area. A full-service property management firm like PPA Properties can market your property, screen potential tenants, show your property to qualified tenants, and offer 24/7 maintenance.

From finances to maintenance to management, there are so many tiny steps you need to take to ensure that your investment property turns a profit. Guides like this one can make buying and owning your first rental property easier, though. Follow it, and you’ll be a successful landlord in no time!

For a free rental analysis and to learn more about their property management service, call PPA Properties today at 919-477-4499!